bank owned life insurance tax treatment

There are important distinctions however in how this term BOLI may be used that should be understood. Tax treatment is changed existing plans may be grandfathered.

Common Mistakes In Life Insurance Arrangements

But if they are not grandfathered they may be surrendered for their cash surrender values.

. 101 j 1 was added with the enactment of the Pension Protection Act of 2006 PL. Many banks now own BOLI bank owned life insurance. Heres how it works.

The tool is designed for taxpayers who were US. Since the 1980s banks have purchased bank-owned life insurance or BOLI for various business purposes most commonly to recover losses associated with the death of a key person to recover the cost of providing pre- and post-retirement. If the tax treatment is changed existing plans may be grandfathered.

What are the requirements for deductibility. Rulings concerning the federal income tax consequences regarding the recognition of a loss on the surrender of bank owned life insurance BOLI submitted by Taxpayer. If the tax treatment of Bank Owned Life Insurance BOLI changes existing plans may be grandfathered.

However if they may be surrendered for their cash surrender values. FACTS Taxpayer is a national banking association and is wholly owned by Parent a holding company and bank holding company. Taxpayer qualifies as a bank within the.

The tax treatment of corporate-owned life insurance COL I continues to receive scrutiny from congressional tax writers and the Obama Administration. More Company-Owned Life Insurance COLI. This general rule changed when Sec.

However an IRS rule codified in IRC Sec. The new provision could have unintended consequences for bank mergers and. The death benefit proceeds follow this same model as long as banks abide by federal rules governing the use of BOLI.

The primary benefit of BOLI is its treatment for corporate income tax purposes. Course CPA Principal Federal Reserve Bank of San Francisco. The sweeping Tax Cuts and Jobs Act TCJA signed into law in late 2017 includes a provision that appears to apply to bank-owned life insurance BOLI which often is used as a tax-free investment for banks sometimes but not always coupled with an employee benefit program.

But there are times when money from a policy is taxable especially if youre accessing cash value in your own policy. The new section limits the amount of tax-free treatment a person which can be any type of entity can. Citizens or resident aliens for the entire tax year for which.

Corporate Owned Life Insurance COLI owned by banks is often referred to as Bank Owned Life Insurance or BOLI. Bank Owned Life Insurance and Tax Reform. Upon the executives death tax-free death benefits are paid.

In general life insurance benefits received upon the death of an insured are tax-free. It should be noted that BOLIs current tax benefits have been unsuccessfully challenged over the years. 3200 Conclusion The use of Life Insurance may be a key financial decision for your business.

IRC 101 j applies to employer-owned life insurance. Bank Owned Life Insurance BOLI is the predominant investment asset for financing the cost of employee benefit plans. The bank purchases and owns an insurance policy on an executives life and is the beneficiary.

Understanding its impact on the financial statements of your business is an important element in making a decision on the use of a business owned life insurance policy. The face amount of the policy if specified in the policy. Executive Benefits Network has helped.

101 j subjects employer owned life insurance benefits to taxation unless they qualify for an exception and Notice and Consent requirements are satisfied. The tax issues associated with key person term life insurance are relatively unambiguous. Bank-owned life insurance is bought by banks as a tax shelter leveraging tax-free savings provisions to fund employee benefits.

Bank Owned Life Insurance BOLI Bank Owned Life Insurance BOLI is defined as a company owned insurance policy on one or more of its key employees. A Primer for Community Banks by Cynthia L. If you are receiving the proceeds in installments whether there is a refund or period-certain guarantee.

Life Insurance premium expense account. 264 a 1 provides No deduction shall be allowed for premiums on any life insurance policy. If the taxpayer is directly or indirectly a beneficiary under the policy or contract The tax treatment of death benefits associated with such a.

In general proceeds from life insurance policies are tax free under the general exception rules in Sec. If federal income tax was withheld from the life insurance proceeds. 5000 Life Insurance income account.

The buildup of cash surrender value within the policy is included in book earnings but excluded from the calculation of federal taxable income. The tax treatment of proceeds paid on the death of the insured is unaffected by the fact that the contract is a MEC. Life insurance payouts are made tax-free to beneficiaries.

While progress toward reform of the Internal Revenue Code IRC may slow in light of the upcoming congressional midterm elections a proposal that. Bank Owned Life Insurance BOLI is a tax efficient method that offsets employee benefit costs. However if existing policies are not grandfathered they may be surrendered for their cash surrender values.

While the day-to-day accounting and handling of death benefits received are fairly straight forward for financial reporting and tax purposes an institution on the selling side of an MA transaction with BOLI may face additional tax considerations based on the structure and terms of the sale agreement. In order for all or a part of premiums payable on an insurance policy to be deductible the following requirements must be met in accordance with. A life insurance policy used as collateral security may be an allowable deduction under paragraph 201 e2 of the Income Tax Act the Act.

Cash surrender values grow tax-deferred providing the bank with monthly bookable income.

Life Insurance As A Tax Planning Tool Insights People S United Bank

Irs Foreign Life Insurance Policy Taxation Is Income Taxable

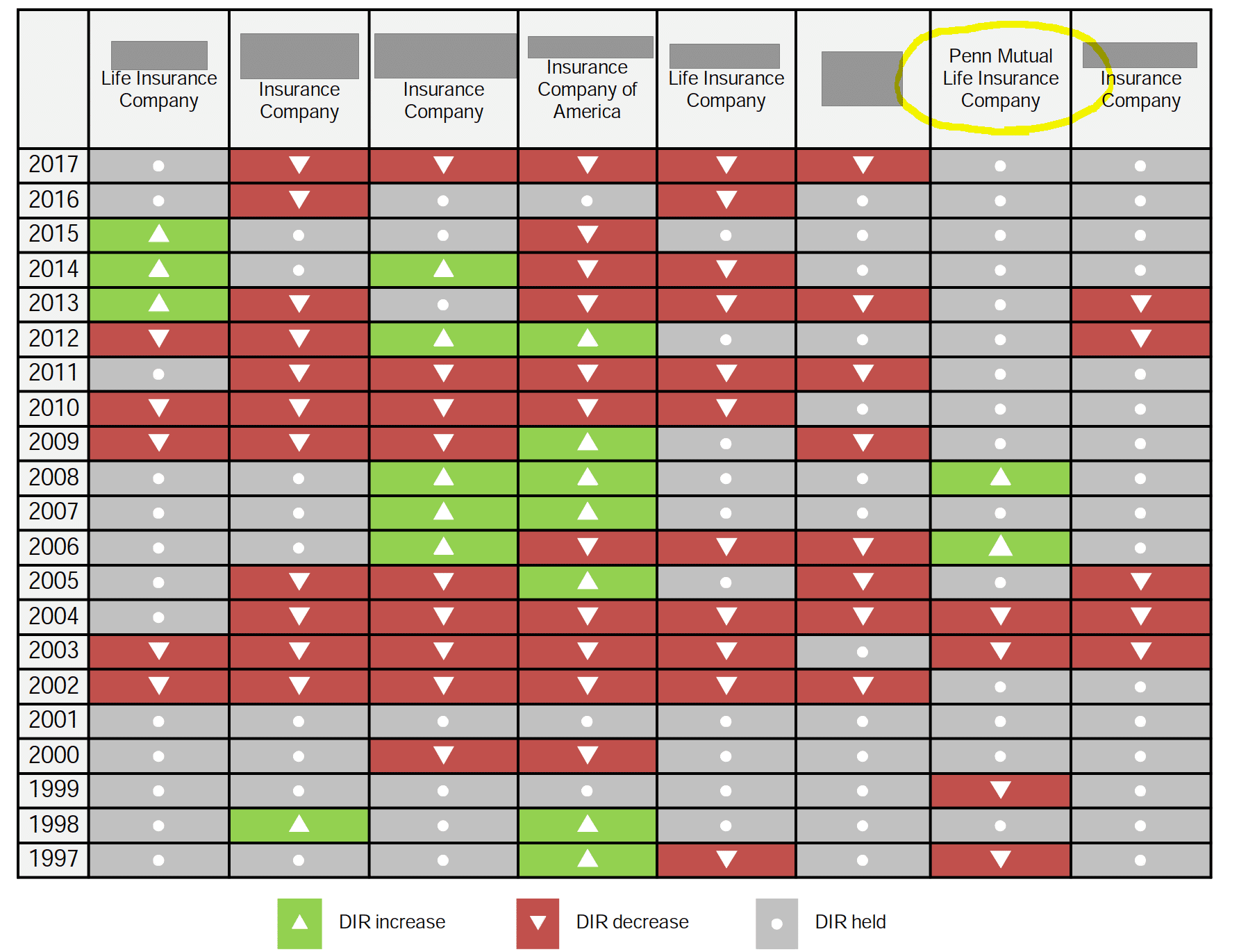

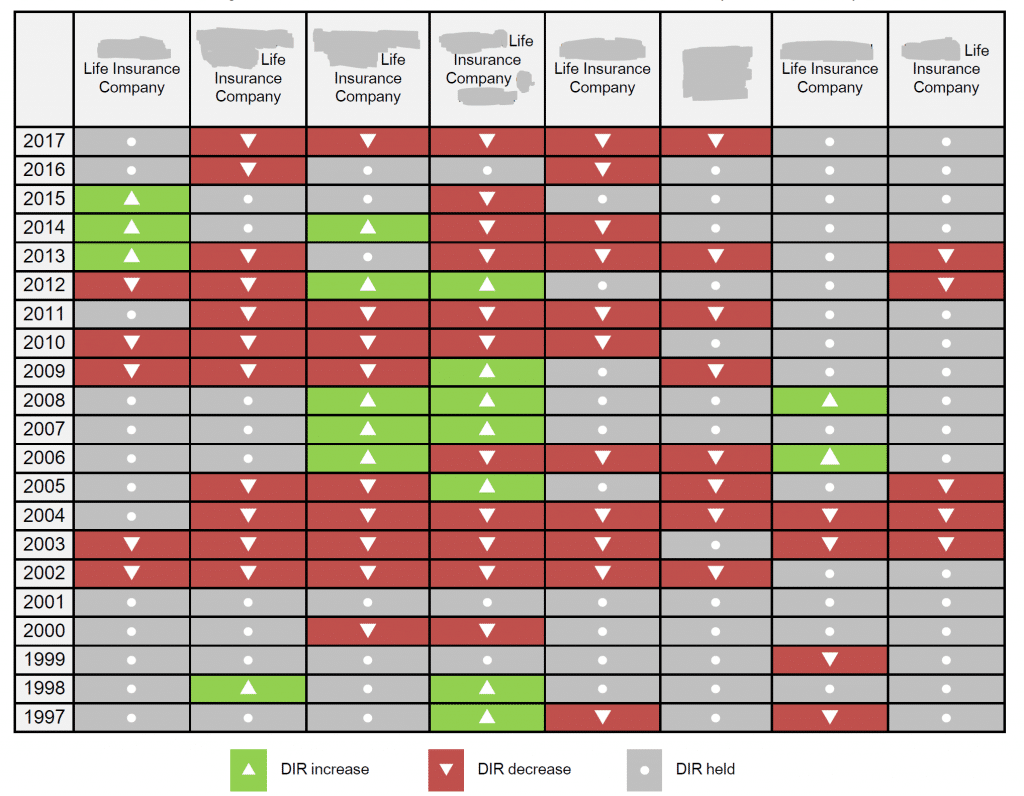

Dividends From Whole Life Insurance Explained Bankingtruths Com

:max_bytes(150000):strip_icc()/HowDoesLifeInsuranceWork-dd125debc30e4f48bd805fdb13fc98b9.jpg)

Life Insurance Companies Policies Benefits And More

Dividends From Whole Life Insurance Explained Bankingtruths Com

Life Insurance Policy Loans Tax Rules And Risks

Do Beneficiaries Pay Taxes On Life Insurance

Life Insurance Policy Loans Tax Rules And Risks

Can Life Insurance Affect Your Medicaid Eligibility

Life Insurance Loans A Risky Way To Bank On Yourself

Are Life Insurance Premiums Tax Deductible In Canada

Cash Flow Banking With Whole Life Insurance Explained

Lirp Life Insurance Retirement Plan Best Companies Pros Cons

Dividends From Whole Life Insurance Explained Bankingtruths Com

/hispanic-saleswoman-talking-to-clients-in-living-room-580504711-5995f8d722fa3a001149763c.jpg)

Life Insurance Death Benefits And Estate Tax

Common Mistakes In Life Insurance Arrangements

Understanding Life Insurance Policy Ownership The American College Of Trust And Estate Counsel

:max_bytes(150000):strip_icc()/hsbc-branch-in-new-bond-street--london-533780165-ff99ebc393c243cba463ea80559836b0.jpg)